how much is the property tax in san antonio texas

In Bexar County property owners pay taxes. 33 rows San Antonio citiestowns property tax rates.

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Do not confuse market value with taxable value as the taxable value is determined by the county and not the market.

. Maintenance Operations MO and Debt Service. Tax amount varies by county. Each unit then is given the tax it levied.

Property Tax Payment Plans PDF e-Statement Instructions. In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261. Search Any Address 2.

Adult members of Generation Z are experiencing food insecurity at over twice the rate of the average American according to our latest consumer food survey. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. See Property Records Tax Titles Owner Info More.

This is also close to 60 higher than what most other Americans pay in property taxes throughout the rest of the country. 25 properties and 25 addresses found on Whittney Ridge in San Antonio TX. 100 Dolorosa San Antonio TX 78205 Phone.

35 properties and 33 addresses found on Capeshaw in San Antonio TX. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The County sales tax rate is. The average lot size on Whittney Rdg is 8363 ft2 and the average property tax is 21Kyr.

This is the total of state county and city sales tax rates. The tax rate varies from year to year depending on the countys needs. The following table provides 2017 the most common.

On average a person in Texas will pay 3327 in property taxes which places the state among the top five in property tax payments. The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. Bexar County collects on average 212 of a propertys assessed fair market value as property tax.

The minimum combined 2022 sales tax rate for San Antonio Texas is. The Texas sales tax rate is currently. County Departments.

The median property tax on a 11710000 house is 122955 in the United States. Setting tax rates appraising property worth and then receiving the tax. In fact about 1 in 3 Americans born.

As of 2018 the property tax rate in San Antonio is roughly 034-035 for every 100 of taxable value for maintenance. The average property on Capeshaw was built in 2016 with an average home value of 176123. 181 of home value.

For example the tax on a property appraised at 10000 will be ten times greater than a property valued at 1000. Overall there are three phases to real estate taxation namely. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

The property tax rate for the City of San Antonio consists of two components. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes. The average lot size on Capeshaw is 6832 ft2 and the average property tax is 520yr.

100 Dolorosa San Antonio TX 78205 Phone. Ad Public San Antonio Property Records Can Reveal Mortgages Taxes Liens and Much More. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Bexar County.

Property taxes for debt repayment are set at 21150 cents per 100 of taxable value. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Look Up Any Address in Texas for a Records Report.

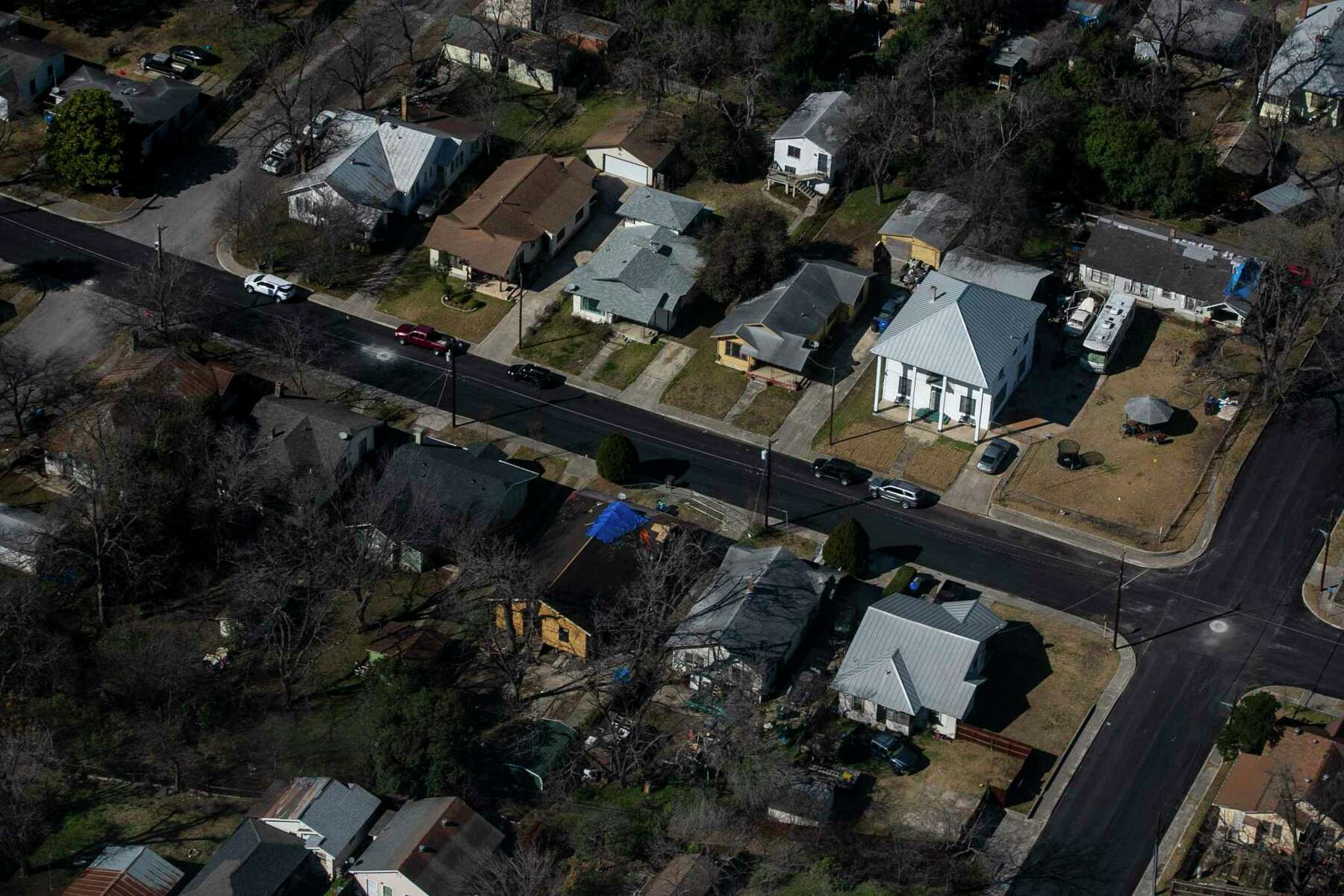

The median property tax on a 11710000 house is 211951 in Texas. A Southtown neighborhood as seen from the air in San Antonio Texas on Feb. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value. Wayfair Inc affect Texas. See Results in Minutes.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. The average property on Whittney Rdg was built in 1977 with an average home value of 101958. Did South Dakota v.

In Latin ad valorem translates into according to value Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value. The San Antonio sales tax rate is. Taxing entities include San Antonio county governments and a number.

San Antonio Real Estate San Antonio Homes For Sale San Antonio Texas

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonians Can Now Take A Larger Exemption On Their Property Taxes For Homesteads Seniors And Disabilities Tpr

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

San Antonio Property Tax Rates H David Ballinger

Pin By San Antonio Board Of Realtors On Take Action Consumer Protection Estate Tax Facts

Property Tax For 65 Over Homeowners Who Volunteer May Be Lowered

Beautiful Listing On 7 Acres In Rio Medina Tx Contact Sue Massari Young For More Information Concrete Stained Floors Gas Fireplace Logs Weekend Retreats

We Will Advise You In Everything You Need And With Fair Prices Call Us 210 892 3900 Fair Price Coffee Maker Price

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate

The Top 10 Reasons To Move To San Antonio Tx Home Money

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

The Rental Contract Has Ended Do You Wish To Re Rent Hance Realty Anticipatedly Programmes So Everything Will Go Well Property Management Realty San Antonio

6 Things New Homeowners Waste Money On New Homeowner Find Real Estate Home Ownership